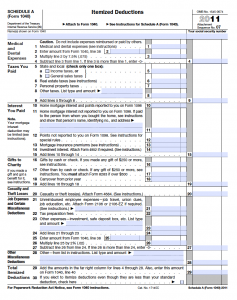

If the total of a taxpayers itemized deductions is greater than standard deduction for the applicable filing status, Schedule A should be used.

If the total of a taxpayers itemized deductions is greater than standard deduction for the applicable filing status, Schedule A should be used.

Here is a summary of deductions which are itemized on Schedule A

- Medical and Dental Expenses

- Taxes Paid

- Interest Paid

- Investment Interest Expense

- Interest – Mortgages

- Points – Mortgages

- Other Mortgage Interest

- Gifts to Charity

- Casualty and Theft Losses

- Job Expenses and Most Other Miscellaneous

- Work-Related Education Expenses

- Legal Fees