For United States individual income tax, adjusted gross income (AGI) is total gross income minus specific reductions.[1] Taxable income is adjusted gross income minus allowances for personal exemptions and itemized deductions. For most individual tax purposes, AGI is more relevant than gross income.

Source: Wikipedia

These deductions reduce AGI. Amounts deductible against gross income in arriving at adjusted gross income (AGI) are called “above-the-line” deductions.

These deductions reduce AGI. Amounts deductible against gross income in arriving at adjusted gross income (AGI) are called “above-the-line” deductions.

- Educators Expenses – Teachers’ Classroom Expenses

- Business Expenses for Certain Employees

- Health Savings Account Deduction

- Moving Expenses

- Self-Employment Tax

- Self-Employed SEP, SIMPLE, and Qualified Plans

- Self-Employed Health Insurance

- Penalty on Early Withdrawal of Savings

- Alimony Paid

- IRA Deduction

- Student Loan Interest

- Tuition and Fees

- Domestic Production Activities

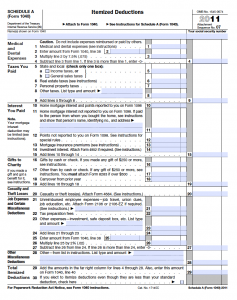

If the total of a taxpayers itemized deductions is greater than standard deduction for the applicable filing status, Schedule A should be used.

If the total of a taxpayers itemized deductions is greater than standard deduction for the applicable filing status, Schedule A should be used.